ARCHIVED

0xTedious December 5, 2022, 8:32pm #1

- per December 2022

First, I apologize for this book of a post. I have tried to compress it as much as I can, but CoreVerse is so vast that I would be doing a disservice to the ecosystem and its community if I squeezed anymore. I will, however start with a tl:dr just below here, so if you are strapped on time, just read that and don’t bother with the rest.

Disclaimer:

I have been a token holder since LSW, have amassed a good chunk of rLP’s, and went bonkers YOLO at one time, so I have over 90% of my crypto portfolio in rLP’s.

I do not in any way represent the project or the developers, nor do I have any inside information. Everything I present is from on-chain research, interpretation, and analytics of written materials and countless hours diving into every aspect of CoreVerse.

To the best of my ability, I have gathered as much on-chain data around CoreVerse as possible. Of course, I might have overlooked something, or I might have done an erroneous calculation someplace. Still, I try to present all the data I have found on-chain and flag any assumptions I make explicitly.

My professional background is in marketing and economics. On top of that, I have experience with project management focused on QA from project owners PoV. This means I have a bunch of biases that I try and keep in check when I do research like this. So when I use words like liabilities, that is an occupational hazard on my part. I have been invested in the cryptosphere since 2017 and have lost more money than I like to admit. I am currently learning to code in Python as I want to build shit instead of just analyzing and investing in shit.

I have the uppermost respect and admiration for the CoreVerse developers.

Tl:dr

Funds are safu!

Wagmi

There is approximately $80M worth of assets on-chain across the wallets in the CoreVerse under the developers control.

This is as brief as I can do the tl:dr, for the rest, buckle up and get ready for the ride into TediousLand. ![]()

Table of Contents:

My views on Status Quo:

CORE Liquidity Generation Events:

CORE/CoreDAO Treasury intro:

Limited Staking Window (LSW):

LSW-ROI:

CoreVerse Treasury:

Fanny:

Development funds:

My views on Status Quo:

There are several reasons why I am writing this long ass post. I have, over a long time, gotten annoyed by all the moonbois claiming CORE is a slowrug and that complaining x and y, when it takes less than 5 minutes to confirm that CoreVerse has about $80M still on-chain, on top of making $20M worth of DAI available for personal loans on cLend, with currently $16M lent out.

Don’t get me wrong. I understand the frustration a lack of communication infuses and how that adds to the uncertainty one feels, but going from that to coming into the telegram groups with a sense of entitlement is just annoying for the patient of us. I think it is counterproductive for the sake of development as well. I understand when the delays first started happening, that people came and complained as the dev’s TG modus operandi was still not established, but it has been made abundantly clear that no amount of complaining will make them magically fulfill our dreams and hopes in the timely manner we wish.

Personally, I think the reason CoreVerse has still not launched is that along the way they started acting on their ultimate vision, I think they had a little pivot in strategy from launching small and growing to building in silence and launching massively.

I think it is a combination of events that made them go radio silent on progress, one is that when they launched CORE LGEs, they got copycatted like mad, Encore for example had a whooping 10,000 ETH liquidity locked, on a forked contract of CORE. Another is when they launched Delta, pretend-DEX Unicensorship went all Adolf on them, even though he had never before cared or trying to prevent people from being scammed by actual rug-pull scammers on his centralized-DEX. And on top of this moonbois bicker whenever they don’t deliver as initially estimated. I think this just got them to go all-in, building what they intended as the final deliverance as the first deliverance, as with them having control of all the funds on-chain, they can work as slowly as they need to keep it all secure. Considering all the hacks and theft that have happened in blockchain land, this should be of the highest importance for us all.

Another thing I want to add is the outfall from when The U.S. Treasury Department’s Office of Foreign Assets (OFAC) went after crypto mixer Tornado Cash(1). GitHub removed its code repositories to comply with the actions of OFAC, which shows how incredibly fragile infrastructure can be. That shows all the different attack vectors an anon project like CoreVerse has to factor in.

And let us not forget, they have delivered several milestones, we get too blasé with not appreciating what we get.

- The CORE LGE contracts were one of a kind when they first arrived. It is top-notch work.

- The Delta contract with the low gas cost albeit the complexity of the contract.

- (Not a CoreVerse deliverance, but 0xRevert’s whitehat bug bounty hack of FEI/Tribe, which again shows a technical brilliance.)(2.)

- Q2 2021 – Converted BTC and ETH in LGE1 and LGE2 LP pairs to DAI, locking in the total value of LGE1, LGE2, and LGE3 LP pairs at over $54M.

- Q2 2021 – Converted LRV’s ETH to DAI, locking the total value at over $21M.

- 8th February 2022 – Introduction of cLend, loans on CORE and CoreDAO. (3.) They have made $20,000,000 worth of DAI available for lenders, of which $16,546,600 has been lent by token holders. For LGE1 investors, this loan equals around 10x if they use it as exit liquidity. For LGE2 investors, it equals approximately 5x.

- 24th February 2022 - Introduction of Stable Yield for Delta and rLP farming. (4.)

Link 1: Crypto-Mixing Service Tornado Cash Code Is Back on GitHub

Link 2: Fei Protocol Vulnerability Bugfix Review | by Immunefi | Immunefi | Medium

Link 3: cLEND Launch. The protocol is moving towards full… | by 0xdec4f | CORE Vault | Medium

Link 4: Deep Farming Vault: Stable Yield Activated | by 0xdec4f | Delta Financial | Medium

CORE Liquidity Generation Events:

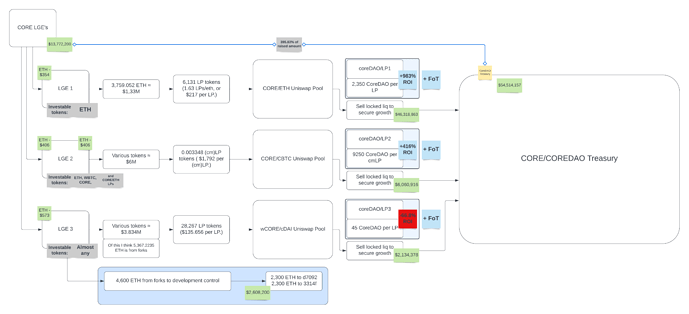

In Q3-Q4 2020, CORE have completed three different Liquidity generation events(LGEs), which raised a combined $13,772,200. Market buys of CORE on top of that, further propelled by overall external crypto growth in the ecosystem’s paired liquidity have skyrocketed the value of the treasury to $54,514,157.

Participants in LGE1 and LGE2 have made a massive profit on their investment, whilst participants in the last LGE, LGE3, has not yet seen a profitable return on their investment, mostly due to the liquidity pair they invested in was paired with a stablecoin, which for obvious reasons missed out on the overall growth in the total crypto sphere, with it being a stable-coin.

The project secured the external growth of the crypto sphere by switching their treasury into a stablecoin.

In LGE3, there was a contribution towards the development fund for the first time to ensure the sustainability and growth potential of the ecosystem.

CORE/CoreDAO Treasury intro:

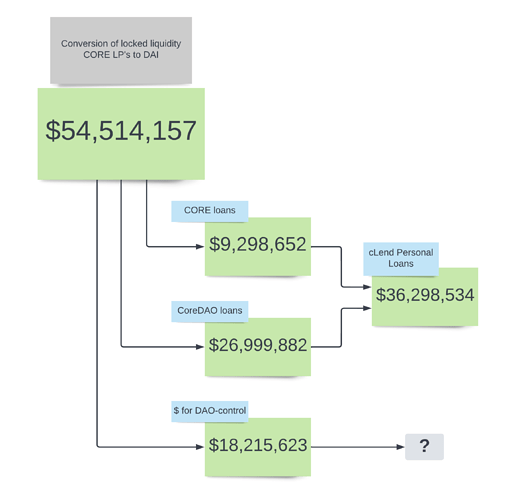

The three liquidity pairs from CORE’s 3 LGEs in Q3 and Q4 2020 were withdrawn from the market in April and May 2021. This liquidity was sold on the open market to secure the growth in underlying assets, Ethereum and Bitcoin. Generating a value for the CORE treasury of $54,514,157.

Then different goals put a restriction on the funds to fulfill the designation the devs have given them.

The introduction of cLend with the ability to take out collateralized loans on tokens CORE and CoreDAO, with CoreDAO with a collateral value of $1 per token and CORE with a fully collateralized value of $5,500 per token. Represents a liability of up to $36,298,534 on the CORE/CoreDAO treasury.

At the time of transition from three LP pools into vouchers and CoreDAO tokens, this is the following data of interest:

1,690.664 «rogue» CORE. What I mean by that is CORE that wasn’t in an LP pair at the time of extraction. $5,500 a pop equals a liability at $9,298,652 of the CORE/CoreDAO treasury funds.

For CoreDAO vouchers, there are according to my knowledge in reading the different wallets, totally created 26,999,882 CoreDAO vouchers, but not all of them are claimed yet, which is why the max total supply of CoreDAO tokens currently is listed at 24,252,064 CoreDAO. With cLend offering $1 worth of DAI loans per CoreDAO tokens, this implies a liability at $26,999,882 of the CORE/CoreDAO treasury funds.

With the cLend liabilities out of the equation, there are then another $18,215,623 left in the CORE/CoreDAO treasury.

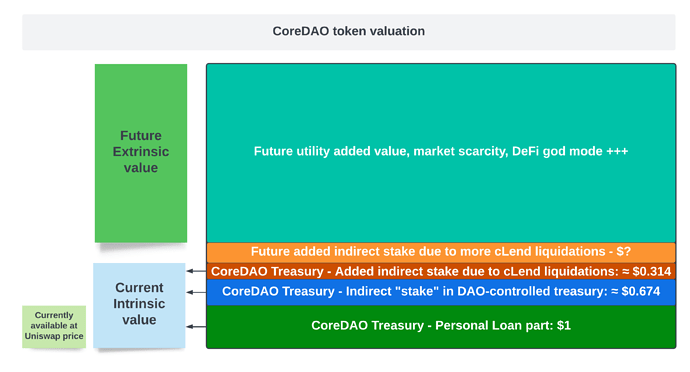

With the wording «maximum collateralized» (1) on CORE loans at $5,500, I think it is safe to assume that CORE tokens have no implied ownership to the remaining CORE/CoreDAO treasury but that the 26,999,882 CoreDAO has a collectively implied ownership to the remaining «common treasury» funds.

Then we have two calculations left to do,

With 26,998,882 CoreDAO tokens to implied own $18,215,623, this equals an indirect ownership of $0.674 per CoreDAO. This is with NO CoreDAO tokens liquidated from cLend.

Please note, when I say indirect ownership, this does not in any way imply that you in any way have access to these funds. I think these funds will be managed by the DAO, but the way markets work, this will eventually be priced into the market price some time in the future.

Then with today’s 8,576,134 CoreDAO either liquidated or in soft-default, the new max total supply of the CoreDAO token is 18,423,748. That adds another $0.314 in indirect ownership per CoreDAO token, bringing the total amount of indirect ownership to $0.988 per CoreDAO.

Note, this has not been communicated from the developers, so this is an assumption. They can do what they want with the DAO-controlled treasury as they see the best-fit long-term for the project. I am just navigating the waters based on interpretations of what has been explicitly communicated.

CoreVerse bought Ethereum and Bitcoin for $11,250,000 worth in DAI using treasury funds 9th of November, so the indirect stake can fluctuate in value over time. For me, this is one of the most attractive elements with a DAO-controlled treasury, as the personal loans give you the ability to get short-term liquidity on your tokens if you need it. Still, you also get to be a part of the entire ecosystem creating value over time with your indirect ownership stake.

Link 1: https://medium.com/core-vault/coredao-and-clend-launch-c7da261ec25

Limited Staking Window (LSW):

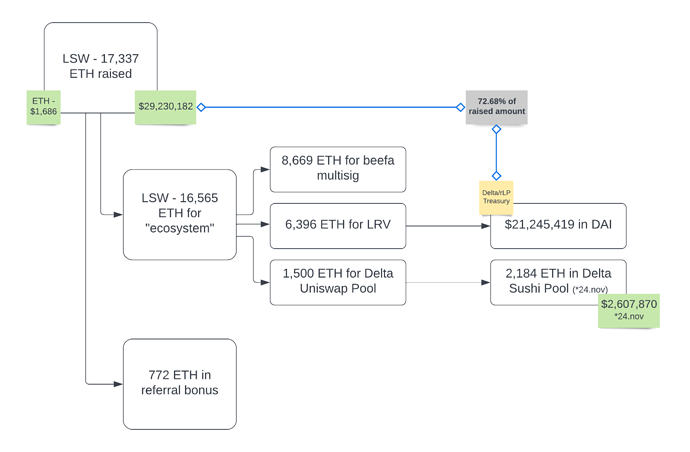

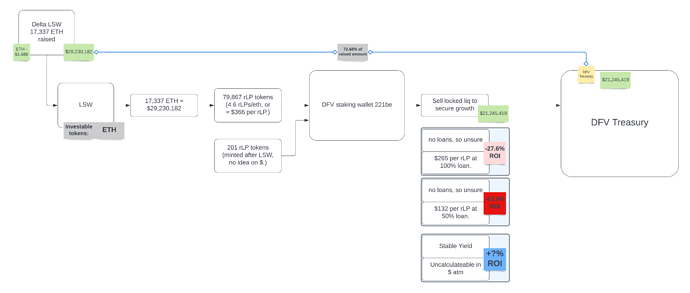

In Q1 2021, CoreVerse held a Limited Staking Window(LSW) on their derivatives platform that will be on top of the CoreDEX. As the image above shows, LSW raised 17,337 ETH, which at the time of the initiating transaction kicking the Uniswap pool and DFV into action, was valued at $29,230,182, with Ethereum valued at $1,686. This amount is arguably higher than what was committed. I calculated the conversion rate of ETH to $ at the time of my contribution to finding my price per rLP. But for fairness and simplicity, I used the value of Ethereum at the time the project «took control» over the assets.

Delta divided the raised funds into four, with 50% going for the development of the project, here displayed as the 8,669 ETH going for the beefa multi-sig. 36.9% went into the liquidity reserve vault, and 8.65% was used as the initial liquidity for the Delta/ETH pair on Uniswap.

24th of February 2022, the project transferred $21,245,419 DAI to the D5346 wallet after having sold the LRV’s balance of ETH to stablecoin DAI to secure the underlying growth of value in Ethereum. This ensured a Treasury for Delta and rLP, which sizewise equals 72.68% of the total amount that was raised in the LSW. Big brain move and very beneficial for the ecosystem.

In this post, I will return to the assets transferred to the beefa multi-sig.

LSW-ROI:

With the Delta platform not being launched yet, it is challenging and kind of silly to calculate an ROI on that investment. Same with loans, since rLP is not accepted as collateral in cLend, it is also difficult to calculate an ROI on an eventual exit through a loan liquidation as that is not possible at the current stage. But I include it here as it pertains to other things I will discuss further in this post when I compare it to CORE.

24th of February 2022, Delta activated the Stable Yield provision(1), ensuring a minimum yield for stakers in the DFV. The project added 5 million Delta, projected to last for a year, with 90,053 Deltas to be distributed per week and 100 per week in a tip to the ones calling the distribute contract. Right now, according to the farming power math 1 rLP earns 0.943 Delta’s per week. But with earned Delta having a 365-day vesting period before becoming «sellable,» it is not useful to try and calculate an ROI on it. But, when the ecosystem becomes successful, this transfer of Delta to the DFV stakers is a massive benefit. It just is uncalculatable at the current time.

According to a Medium article(2), the DAI from the ETH in LRV will be used to maintain the floor price, there hasn’t been much explanation of what is meant by this or how this will be utilized in terms of Delta/rLP. When they have used the term floor price before with CORE and LP vouchers (3 and 4), it has been based on what loan percentage and the amount you can get.

To reiterate my earlier point, just because something has been said before does not mean the project will adhere 100% to that. That is one of the reasons the developers stopped giving out updates, as people took everything 110% and had no understanding of delays and changes. That makes it immensely hard to properly communicate from the project’s point of view.

Also, the combination of a bunch of moonbois as token holders with extremely skilled developers having the bedside manners from a lovechild between Dr. House and Jonny Lee Millers portrayal of Sherlock Holmes made the toxicity just epic. It made a lot of Moonbois run for the hills.

Link 1: Deep Farming Vault: Stable Yield Activated | by 0xdec4f | Delta Financial | Medium

Link 2: Deep Farming Vault Update: Stable Yield | by 0xdec4f | Delta Financial | Medium

Link 3: coreDEX: Lending. Soon you will be able to loan out your… | by 0xdec4f | CORE Vault | Medium

CoreVerse Treasury:

)

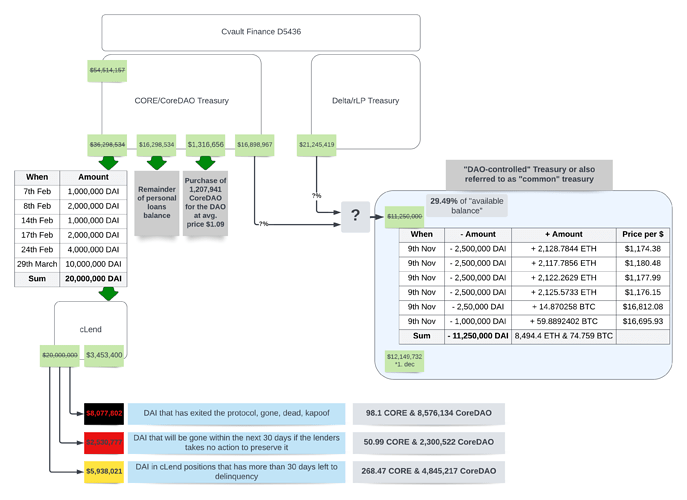

This image is a bit complicated, but let us go through it step by step.

In 2021 both the CORE/CoreDAO treasury and the Delta/rLP Treasury combined into one unified wallet, the Cvault Finance deployer wallet. It makes it more difficult to follow on-chain, because with all the DAI combined in one place, it is harder to figure out like 9th of November’s purchase when $11,250,000 worth of DAI bought ETH and BTC, the distribution of how much of this move was done using CORE/CoreDAO treasury funds and how much was done using Delta/rLP treasury funds.

In the image, any $ number value with a line through it means that it was the starting amount, but that it has currently changed, and I usually present the new numbers below or next to it.

Over the last few months, there was made several purchases of CoreDAO, totaling up to 1,207,941 CoreDAO for the future use of the DAO, at the cost of $1.09 per CoreDAO on average, «costing» the CoreDAO treasury $1,316,656 worth of DAI.

The CORE/CoreDAO treasury initially had $54,514,157 from removing the three liquidity pairs from Uniswap. However, as I have gone through earlier in this post, $36,298,534 is «budgeted» to cLend for personal loans on both CORE and CoreDAO, which leaves $18,215,623 left in the «common treasury.»

$20,000,000 worth of DAI has been transferred to the cLend wallet, whereas $8,077,802 has currently exited the ecosystem, either as an already liquidated cLend position or as one currently in delinquency which will liquidate at any interaction by the lender or when anyone else chooses to liquidate it. The only thing that could theoretically change this number is if the developers change the LTV threshold to a figure above those who are already delinquent.

There are $3,453,400 DAI left in cLend for new loans, and there are $8,468,798 outstanding loans.

Furthermore, in the D5436 wallet, there is $16,298,534 worth of DAI that is actually «reserved» by cLend loan budgets, and thus the actual available balance of CoreDAO treasury is $16,898,967.

A huge thank you to Daniel_san for helping me collect and systematize the cLend data. That would be way too many transactions to plunder through manually.

The Delta/rLP treasury has a balance of $21,245,419 worth of capital ready to be deployed in the manner that best suits the protocol and ecosystem, like loans on Delta/rLP, DAO-controlled treasury, or other uncommunicated use of funds.

So the 9th of November «investment» of $11,250,000 worth of DAI is impossible to guess if it came from CoreDAO treasury, Delta/rLP treasury, or a combination of both. That investment size equals 29.49% of the combined «available balance» from both the CoreDAO treasury and the Delta/rLP treasury.

Fanny:

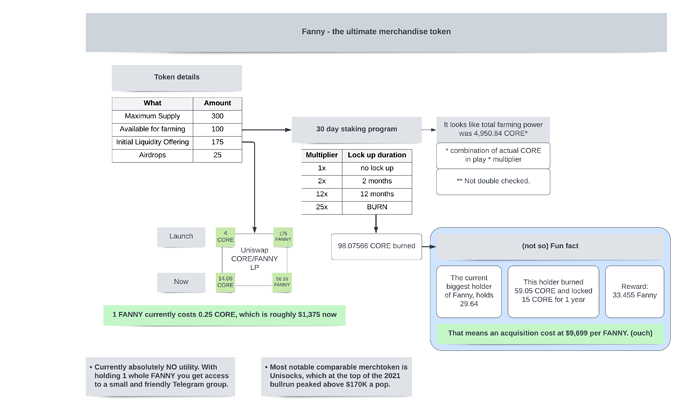

Fanny is a merchandise token(1) that has no promised utility at this point. Still trying to figure out what their future plans of them are. Still, by looking at another unique comparable token, the Unisocks, it is apparent that the scarcity alone, when paired with a popular and much-used project, can skyrocket the value. Unisocks value above $170K a pop during the 2021s peak shows the potential.

Note this is a very high-risk unsure reward token. But a fun one.

Link 1: https://medium.com/core-vault/fanny-limited-edition-merchandise-token-63d19f05ef82

Development funds:

Now, this is a topic I really do not wish to visit because people can get all kinds of ideas and a sense of entitlement, but there is no way to not do it.

I will, for simplicity, divide this up into two parts, part 1 – development funds up until the launch of platform/protocol/ecosystem(pre-launch), and part 2- funds for continued and sustained development after launch(post-launch).

Part 1: Development funds pre-launch.

IMAGE MISSING

To my knowledge, there haven’t been a portion of CORE or any of the Core based LP’s reserved for the developers or towards a development fund until the fork migrations before LGE3, which means up until LGE3, it has been a total utopian fair launch, the only thing that has generated a cashflow for the development is a 7.24% portion of the 1% FoT, this equals 0.0724% of FoT.

Before LGE3 Core opened up so that three forks could migrate into the LGE3, this brought 9,974.42459 ETH into LGE3, whereas 4,600 of those got contributed to the development fund, and this is after my knowledge of the first transfer. This equals $2,608,200 at the time of transfer, percentage-wise this equals 18.94% of total funds raised in all three LGEs.

During Delta’s LSW, there was raised 17,337 ETH, of which 16,565 ETH was distributed within the ecosystem, and 772 ETH was reserved for a referral bonus. Of those 16,565 ETH, the transfer to the development fund was 8,669 ETH, worth $14,613,350, which equals 52.33% of the funds.

If we look at the total amount of funds raised for the development fund, excluding FoT, they have collected a total of $17,221,550 worth of ETH, with Delta’s LSW amounting to $14,613,350 of those, in percentage this is a whooping 84.86% from rLP investors. The reason I am mentioning the percentage contributed is there has been a discussion earlier on the topic of merging, what CORE investors brought to the table DAO-wise, and I think it is important to look at the whole picture.

Huge NOTE, just because there are now on-chain $18M worth of assets in the perceived development fund does not in any way correlate with how it might be in reality. For all we know, there are development contracts with milestones and success clauses, which means that even though the assets appear on-chain, they could be budgeted away, and we would have no knowledge about it. Furthermore, the developers has been very clear on the fact that they intend to build and possibly leave, and let the DAO grow and sustain it going forward, so that could also mean that when CoreVerse is launched those on-chain assets are downpayments for the kick-ass Yacht the devs will buy and retire in. They have absolutely no liabilities towards us on the usage of those funds, they have a responsibility to deliver something, but everything else is up to their discretion.

There have been more funds in play as well. The arbitrage setup earlier in play had some earnings for the protocol/development, but I have not looked into this. And I think the development transfer from LGE3 forks, and LSW represents the majority of funds added. But please correct me if I am mistaken.

I have yet to spend time mapping out how much $ the development fund has spent on-chain. As for me, it was enough seeing there were still a lot of funds available on-chain.

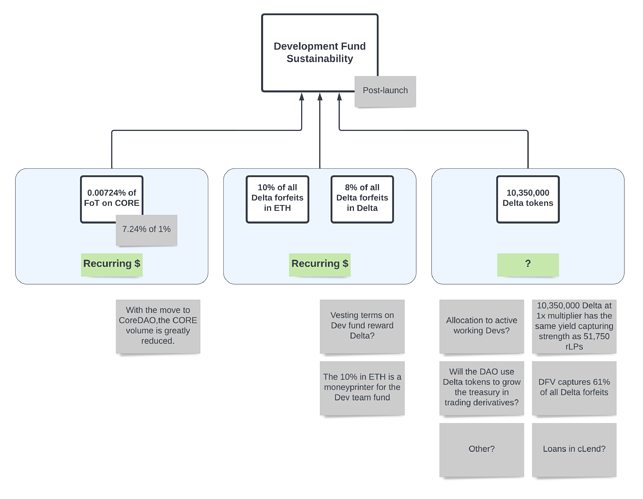

Part 2- Development funds post-launch.

It is always more challenging to increase the allocation to dev fund after launch, as token holders will feel more of a sense of loss, as their portion will be decreased to accommodate the increased need for the ecosystem.

With CoreVerse being fully anon and the developers have stated that they do not wish the protocol to be dependent on them post-launch, this means there have to be mechanisms in place to be able to both attract and retain top-of-the-line developers, both to sustain the then status quo, but also to grow. The recent series B funding round of pretend-DEX Uniswap at $165M shows how costly it can be to stay competitive in this market. (1) Needless to say, the future size of development funds will potentially be massive.

At the current stage, there is very little FoT on CORE, so that value-generating source, without something in the books that we arent aware of, will be almost non existent in the future.

The Delta Team Fund getting 10% of all Delta forfeits in ETH will be massive once the platform gets traction if there is enough sustained motivation for people to forfeit their Delta. Same with the 8% of forfeits in Delta, as we do not know if those are bound by any vesting period or if they are useable from the start.

The 10,350,000 Delta that is in development control is really really interesting. How this stack of Deltas ultimately gets put to use is hard to predict. However, if it simply gets put into DFV the 10,350,000 Deltas have the same farming power at 1x as 51,750 rLP’s.

A company has costs to pay, generally in a regular fashion, same with compensations for work done, so the ecosystem will need to have something sustainable and ideally self-growing to sustain the ecosystem long term. The Delta tokens in the DEV Team fund is ideal for this, as the Delta token has an amazing yield capturing ability, which is why I think the DFV is structured the way it is, to ensure the longevity of the ecosystem. From the perspective of the ecosystem, the most optimal use of the Delta tokens would be to capture yield in DFV and redistribute the rewards to cover costs and development costs. This could be done with one wallet doing it all, or distributing parts of Delta to DAO-controlled smart contracts where smaller groups of developers or even single developers get compensation from these smart contracts, then when said developers leave the project the Delta tokens can be retained by the ecosystem, instead of more risky giving away Delta tokens in lump sums. Note I am not talking about compensation to our current developers now, as if they want a lump sum Delta for deliverance or on their departure, I am all for it. I am talking about sustainable structures around the future handling of come-and-go devs.

With CoreDAO being the new primary token of the CORE part of the ecosystem, it could be beneficial to include for example a 5% to dev fund from any future staking rewards of CoreDAO. So like from the future equivalent DFV of CoreDAO, 95% goes to the stakers, and 5% goes to dev fund.

Link 1: Decentralized Exchange Uniswap Raises Big $165M Series B

Part 3- Needed changes?

X3 has earlier mentioned that there could be a minting of CoreDAO before the official launch. He mentioned that existing team members could get positions as payment, and with the earlier light discussions around a possible rLP/CoreDAO merge that would also require more CoreDAO to be minted.

We as token holders, should realize that every successful business makes pivots and changes to both structures and content, and what we are a part of is something of huge future significance. If any token holders are stuck in Don’t touch my pie land, then that will ultimately be bad for everyone. Due to the telegram persona, this project might seem similar to any else of the moonbois meme dog piss rug-pull projects, but I strongly believe it is not.

I think we should strive for fairness but also sustainability. And we should be able to discuss the topic as adults. I have seen several discussions in the different TG groups turning real sour fast as people with money invested do not even want to consider a viewpoint that makes their share of the pie reduce even in the slightest.

5 Likes

0xTedious December 5, 2022, 9:36pm #3

Correction: It has been brought to my attention that the ROI numbers for LGE2 investors is off, as the numbers dont take into consideration the market sells of CORE during LGE2 that got heavily skewed based on price movements as there was a lot of CORE being sold during LGE2, and this affected the personal $ price entrance for LGE2 contributors. That is why the FoT was set at +20% in LGE3 to protect the investments.

All the ROI numbers has been calculated based on the time of finalizing transactions, for the LGE’s and LSW this is the Uniswap pair creation. Means each token holders actual entry $ can vary.

3 Likes

csu December 6, 2022, 4:48am #4

Great CoreVerse summary.