INTRODUCTION

0xSplits is a crypto company creating smart contracts that create payment pipelines that can “split revenue from nft sales, recoup expenses, diversify income streams, withhold taxes and much more.

full disclosure - i like this company a lot, have talked to the devs to use their contracts in my startup. they have a full sdk and ready to deploy contracts, good stuff worth checking out

Take a look at some of the things they have done:

- Split - this is the main base for all contracts.

- its a smart contract that distributes all ETH & ERC-20 tokens (excluding FoT Tokens more on this later) among preset pre-set ownership percentages.

- In other words it will act as a wallet holding ETH or ERC-20 tokens until the distribute function is called and all the funds distributed via ownership percentages.

- Waterfall - its like a split but used when you want to pay a recipient a specific amount before paying anyone else.

- it will have one or more tranches with a threshold or amount of tokens it will receive before paying all residual tokens to other recipients.

- waterfalls are immutable and will continue to flow and tranches do not reset or restart. the only way to restart the sequence is to redeploy a new waterfall.

- this is useful as a debt instrument when you want to payback a single entity first then distribute equally all of the parts.

- Swapper - same as split but converts all incoming tokens into a single output token. this is done according to an oracle’s clearing price. if no oracle price the owner can withdraw unsupported tokens.

- Recoup Template - a waterfall on top that points to several splits. this allows you to split profits without splitting revenue.

- Liquid Split - like splits but the ownership is controlled by an NFT

- Diversifier - diversifies the tokens into specific tokens of various ratios.

- Vesting - stream tokens to an immutable address.

0xSplits also has Distribution Bounties - encourages bots to distribute funds and earn a percentage of the splits holdings.

im giving an overview to paint a picture I hope these stimulate the neurons in your brains to think up some cool stuff ![]()

This reminds me heavily of a great crypto company I know called Delta Finance, heard of it?

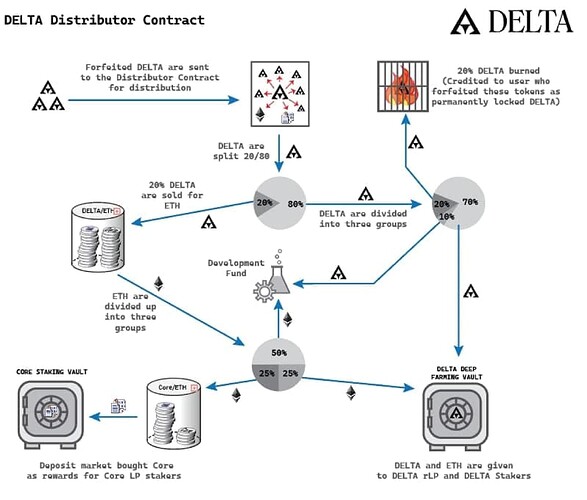

Delta’s contract pipeline is very similar to 0xsplits. Also not in picture: Delta Stable Yield is also a form of split in which case the dev send funds to the contract and they are vested until it is profitable to press the button for them and the entire community.

Fee of Tranfer tokens like core and delta cannot be used with 0xsplits since the funds need to be pulled and this did not work for FoT tokens and i’ve talked to split devs about this (full disclosure they helped out with this on my nft startup). but since the core dev team has def done similar stuff i am sure its a walk in the park for them.

IDEAS

DELTA - already has a robust pipeline and so i am not going to discuss it too much because i have no idea on what to do? what do you guys think? im interested in hearing your opinions.

The only thing i can think of is that maybe there can be a waterfall-style of payment done to stable yield (monthly/quaterly/yearly/periodically) before giving it to the DFV.

example when you forfeit delta, 20% of it is sold for eth and the remaining 80% is further divided into three categories: 1. 20% delta burned , 70% deep farming vault , and 10% deployer , so that means that for total delta forfeited:

56% is given to the DFV

20% Sold for ETH

16% is Burned and credited to farming in DFV

8% is Given to Deployer Wallet

we could add a waterfall style tranche pipeline system for the 56% given to the DFV in which every month 100K delta gets filled first for the stable yield & the rest of the delta is given directly towards the DFV. Farmers will still farm, this is just an addition to secure and prioritize stable yield rewards before commiting to the DFV. at the start of each month the cycle can reset and claim a portion of the delta rewards to refill stable yield before committing it to the DFV. there should be some time limit (5 days?) to make sure that if rewards are low you can still commit something to the DFV.

For CORE, specifically for

cLEND → interest payments should be in some form of split-like contract. this contract can push funds into dev funds, stakers, vault incentives, etc but more importantly to have some sort of harvest strategy so that it get botted. with this you can save up a lot of time since the dev doesnt have to distribute funds manually. possibly the first time claimed we have to do this manually.

CORE FoT - right now the core FoT is at 1% for every transaction, and this is split automatically 93% to the CORE Vault & 7% to the protocol - owned treasury (or deployer address). We could add a splitter here either replacing one side or as a third. this spliter can further downstream core into vaults and products very easily or perhaps even burn core out of every transaction. we can do many things with these ideas:

- autosell core for eth for deployer funds. benefits: devs have less incentive to manually sell core, have eth to pay devs. use the main pool directly contributing to the FoT.

- autoburn core - send core directly to deadbeef out of every transaction. benefits: adds security to the system via scarcity.

- use core in further products like staking or vaults. benefits: core volume and flow of token.

- core swapper or diversifier - if you have some form of coreDEX you can also use this core to diversify into some other token.

coreDAO gov - we have no idea what the coredao contracts entail, and my understanding is that they are building it themselves. i have a couple of ideas for this. (i am deeply sorry if i make coredex take another 48hrs ![]() )

)

first things first, monkeys going to be monkeys , apes gonna ape. if we want the most participation in a core voting proposal you add buttons and you add a motive to press button.

the idea is the contract gets core from the FoT. slowly this increases with every transaction since its tied in to the FoT. whenever a proposal for the dao is presented the proposal will be worth the amount of core in the contract at the time of voting. normally voting contracts save some form of snapshot so at finalizing the voting period each unique wallet that participated in the proposal gets core divided equally by unique participants or some other form. I think its tricky to decide how to divide it at the end because of many different ways it can be gamed like making 50 acounts with coreDAO? not sure, but overall the idea is to incentivize participation via distributing core to participants. lesser important decisions can be made using a sign-in service like snapshot but on-chain voting can be made much more important by putting money in the line.

i imagine this contract can be similar to delta stable yield in which the contract starts accumulating the token slowly but in this case the distribute button can only be called whenever a vote is completed. usually devs take a minimum 6 month period update maybe during this time we can also accumulate CORE for a VOTE.

what do you guys think? im interested in hearing your opinions and other ideas that you could have like this ![]()