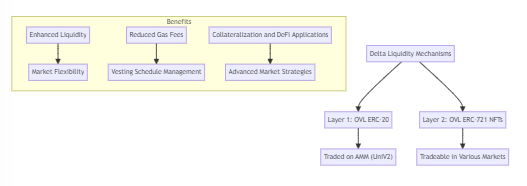

This proposal discussion aims to enhance the utility of the Delta ecosystem by transitioning from Open Vesting Liquidity (OVL) ERC-20 to OVL ERC-721 NFTs. This transition mirrors the shift from UniV2 to UniV3, offering advanced liquidity mechanisms and market dynamics.

This approach aligns with DeFi’s trend towards more sophisticated financial instruments.

- OVL ERC-20 as UniV2: Maintain the current system for simplicity and stability.

- OVL ERC-721 as UniV3: Implement the new NFT-based system to leverage advanced liquidity mechanisms and market dynamics.

Key Features:

- Delta tokens are locked in NFTs, which can be traded in secondary markets.

- NFTs unlock their underlying Delta tokens only at the end of the vesting period.

Benefits:

Enhanced Liquidity:

Transferring liquidity into NFTs allows for more precise control and active trading strategies.

Market Efficiency:

NFT trading facilitates market-driven price discovery, benefiting both long-term holders and short-term traders.

Options-Like Trading:

The ability to trade vesting schedules brings an options trading experience to Delta, enriching the ecosystem.

Potential Reduction in Gas Fees:

Trading Delta in NFTs could potentially diminish the gas required to interact with these contracts.

Since Delta NFTs can be traded in markets, they introduce a speculative aspect to the ecosystem

Vesting Schedule Management:

The NFT format allows for precise management of vesting schedules.

Collateralization and DeFi Applications:

Delta NFTs can serve as collateral within the Delta ecosystem or potentially in other DeFi protocols that accept NFTs as collateral. This expands the utility of Delta tokens beyond simple liquidity provision to use cases like borrowing, lending, or participating in more complex financial arrangements.

Integration with Advanced DeFi Strategies:

Integrating Delta NFTs with advanced DeFi strategies such as automated market making, yield farming, or risk management can enhance their utility. These strategies can leverage the unique properties of NFTs to optimize returns and mitigate risks for liquidity providers.

Trading Flexibility:

Unlike UniV3 these positions cannot be redeemed for their underlaying tokens until the end of the vesting period. To counter this problem incorporate an NFT market in which Delta contracts can be traded like options to increase overall market liquidity. Traders can speculate on the value of vesting Delta based on time and market conditions.

Governance and Future Developments:

In the future, Delta NFTs could play a role in governance mechanisms, where holders of specific NFTs may have voting rights or decision-making power within the protocol.

Capital Efficiency:

Similar to UniV3, Delta NFTs can enhance capital efficiency by concentrating liquidity within specific price ranges. This optimization can reduce trading costs and maximize returns for liquidity providers.

Advanced Financial Instruments: Derivatives and Structured Products: NFTs can underpin complex financial products like derivatives or structured products, offering innovative ways to manage risk and capture value in decentralized markets.

references: