Introduction

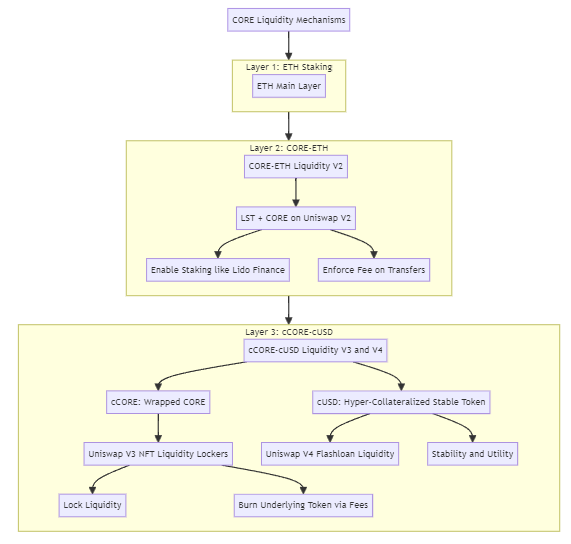

This proposal aims to enhance the utility of the CORE token by maintaining its current V2 liquidity pool (LP) implementation while exploring potential integrations with newer liquidity mechanisms such as V3 concentrated liquidity and upcoming V4 flashloan liquidity mechanisms.

The core objective is to leverage the unique properties of CORE to create a more robust, flexible, and sustainable ecosystem.

Background

CORE is a deflationary token with a unique fee structure that restricts its use to V2 LPs. As decentralized finance (DeFi) evolves, newer forms of liquidity pools, like V3 (NFTs and concentrated liquidity) and soon V4 (flashloan liquidity), are emerging. CORE’s current model limits its participation in these advanced liquidity mechanisms, which presents both challenges and opportunities.

Proposal

Maintain CORE in V2 LPs with COREdex-owned contracts

- Objective: To enforce the transfer fee on the base layer of CORE liquidity.

- Implementation: Use coredex-owned contracts for V2 LPs to maintain the fee structure and enable staking functionalities similar to Lido Finance.

- Benefit: This ensures the deflationary model remains intact while (next part) providing staking opportunities.

Introduce a Locked Staking Token (cETH)

- Objective: To create a liquid staking token that represents staked ETH.

- Implementation: Develop a locked cETH token that users can obtain by staking ETH in the CORE ecosystem.

- Benefit: This token generates staking power and secures the network, adding utility to CORE as a representation of staking node power. While also using the staking yield to back CORE since the liquidity is locked.

Transition to V3 Liquidity Pools

My idea is both options not one.

-

Option A: Wrapped CORE and Token Split

- Objective: To facilitate CORE’s participation in V3 liquidity pools.

- Implementation: Mint a wrapped CORE token and execute a token split (e.g., 1 CORE = 2 cCORE , for centimeter 10^-2). Use an NFT V3 liquidity locker like Circle (ultraround money in base) to lock liquidity and burn the underlying token through LP fees.

- Benefit: This approach locks liquidity while maintaining a deflationary mechanism, enhancing the token’s utility and value.

-

Option B: Vested Locking and Hyper-Collateralized Stable Token

- Objective: To create a stable token backed by staking tokens.

- Implementation: Lock staking cETH in a contract to mint a hyper-collateralized stable token based on LST like Prisma Finance . Let users get back their underlaying after an initial period of time.

- Benefit: This provides unique stability and utility properties due to the hyper-collateralized nature and staking backing. Also users that dont want to lock in eth can have another option that perhaps does not involve hard locking but could have a vested time limit.

Developing COREUSD and Expanding cCORE Usage

- Objective: To introduce COREUSD as a stable token and expand the use of cCORE in various liquidity mechanisms.

- Implementation: Utilize the base layer of staking ETH to back COREUSD and integrate cCORE into V3 and V4 liquidity models.

- Benefit: COREUSD and cCORE enhance the ecosystem’s stability and deflationary properties, enabling broader participation in modern DeFi mechanisms.

References

- CORE LST Compounding the Floor

- CORE Layer: A Restaking Primitive for COREDELTA

- COREUSD: Locking CORE LST to Generate Stability

EDIT

Possible Pros and Cons

Pros

- Maintaining Deflationary Model:

- Pro: Retaining the V2 liquidity pool implementation with COREdex-owned contracts ensures that CORE’s deflationary model remains intact, preserving the token’s scarcity and value proposition.

- Staking Opportunities:

- Pro: Introducing staking functionalities similar to Lido Finance can attract users interested in earning passive income through staking rewards, thus increasing user engagement and network security.

- Increased Utility through cETH:

- Pro: Developing a liquid staking token like cETH allows users to earn staking rewards while maintaining liquidity. This enhances CORE’s utility by representing staking node power and securing the network.

- Flexibility in Liquidity Provision:

- Pro: Allowing users to choose between V1 (ETH staking), V2 (spread liquidity), V3 (concentrated liquidity), and V4 (flashloan liquidity) pools provides flexibility, catering to different user preferences and strategies. This can lead to higher user satisfaction and broader participation.

- Participation in Advanced Liquidity Mechanisms:

- Pro: Transitioning to V3 liquidity pools through wrapped CORE and token split or creating a hyper-collateralized stable token enables CORE to participate in modern DeFi mechanisms. This can increase liquidity, reduce slippage, and attract sophisticated investors.

- Introduction of COREUSD:

- Pro: Introducing COREUSD as a stable token backed by staking ETH can provide stability to the ecosystem. It offers a stable store of value and can be used in various DeFi applications, increasing CORE’s overall utility.

- Enhanced Ecosystem Stability:

- Pro: The combined approach of using locked staking tokens, hyper-collateralized stable tokens, and integrating these with V3 and V4 liquidity models can create a robust and flexible ecosystem. This diversification can make the ecosystem more resilient to market fluctuations.

- Inclusion of Normal ERC-20 Tokens:

- Pro: Allowing normal ERC-20 tokens without tax that can be easily bridged increases interoperability and flexibility. It enables easier integration with other DeFi protocols and ecosystems, enhancing CORE’s accessibility and usability.

- Innovative Token Models:

- Pro: By leveraging innovative token models like cCORE and COREUSD, the proposal adds new dimensions to the CORE ecosystem, potentially attracting more users and developers interested in experimenting with these advanced DeFi concepts.

Cons

- Complexity and Implementation Challenges:

- Con: The proposal involves multiple complex steps, including developing new tokens, implementing staking functionalities, and transitioning to advanced liquidity pools. This complexity could lead to potential implementation delays and increased risk of technical issues.

- User Confusion:

- Con: Introducing new token models like cETH, wrapped CORE, and COREUSD might confuse existing users. Educating users and ensuring they understand the benefits and usage of these tokens could be a significant challenge.

- Liquidity Fragmentation:

- Con: While the proposal allows users to choose between different liquidity mechanisms (V1, V2, V3, V4), it could lead to liquidity fragmentation. Even though the liquidity is connected, reduced liquidity in individual pools might increase slippage and reduce the overall effectiveness of liquidity provision.

- Regulatory Risks:

- Con: Creating stablecoins and new staking mechanisms could attract regulatory scrutiny. Ensuring compliance with evolving regulations in different jurisdictions might require significant resources and ongoing adjustments.

- Economic Risks:

- Con: The success of the proposal heavily depends on market adoption and the performance of the underlying assets (like ETH for staking). Market volatility and changes in the DeFi landscape could impact the effectiveness and stability of the proposed mechanisms.

- Security Concerns:

- Con: Implementing advanced liquidity mechanisms and new token contracts introduces additional security risks. Smart contract vulnerabilities, potential exploits, and the need for rigorous auditing could increase the risk and cost associated with the proposal.

- Dependency on ETH Staking:

- Con: The proposal’s reliance on ETH staking for generating staking power and backing COREUSD ties CORE’s success to the performance and security of the Ethereum network. Any issues with Ethereum staking could directly impact CORE’s stability and utility.